Land x Food = proper RWA

Dec 1 | by mono

You probably know the Native American saying. “When the last tree has been cut down, the last fish caught, the last river poisoned, only then will we realize that one cannot eat money.”

And you know it's true.

Let me "alter" this saying, while keeping the truth intact. “When the last BTC has been mined, the last gold bar stolen, the last petroleum field burned, only then will we realize that one cannot eat money.”

This isn't a rant of any kind, but a gentle reminder the agriculture industry is facing a lot of trouble. Wars, inequality, political agendas and ideologies, "secret" projects like the 2030 agenda (I'm not even a conspiracy theorist, btw), these are just a few that are dealing blows to the agriculture industry and, subsequently, to all of humanity, from farmers to consumers. And we're all consumers. No farmers, no food. No food, well no life.

If you've ever been hungry (like, broke and hungry), you'd probably understand the importance of food in a way deeper manner.

Although the era of tokenization is slowly (but safely) on the rise, I find it unpleasantly confusing (and extremely disappointing) that more money is being invested in money /financial instruments (so, thin air backed by thin air backed by conviction, lies, politics etc.).

Do you ever wonder why Bill Gates owns 275000 acres of farmland in the US alone?

That's ~111228 hectares. In km², that's ~1112.88 km². If you want it in even simpler terms, that's an area the size of 33.36km x 33.36km. For my American brethren and sisters, that's 20.7 miles x 20.7 miles.

"Fun fact": the largest owner of US farmland (31%) is. Canada.

Anyway, back to the main topic.

According to the 2024 FAO report, more than 700 million people worldwide are facing hunger. That's close to 10% of the planet's population. Do you really think the world needs more oil, Bitcoin, gold etc.?

Bitcoin, gold, and oil will just make the rich become richer. They will also cause more wars. And in the end, it's the "little man" that suffers. Yes, we all need money, a house, a car, and all that, but what's the point of owning any of these if we have nothing to eat?

WHAT DOES ALL OF THIS TO DO WITH CRYPTO AND LANDX?

It's simpler than you think. LandX is the interconnection between real world farmers, DeFi maxis, financial institutions (banks), and all with the same goal - to help real world farmers attract capital so they can grow and harvest crops, leveraging blockchain tech, while simultaneously "feeding" DeFi maxis that sweet yield.

Let's take a brief look at some stats. They're not gigantic (in comparison to, for example, Ondo or other "RWA" projects that tokenize the US Treasury), but they're more praiseworthy because of the noble nature LandX comes with.

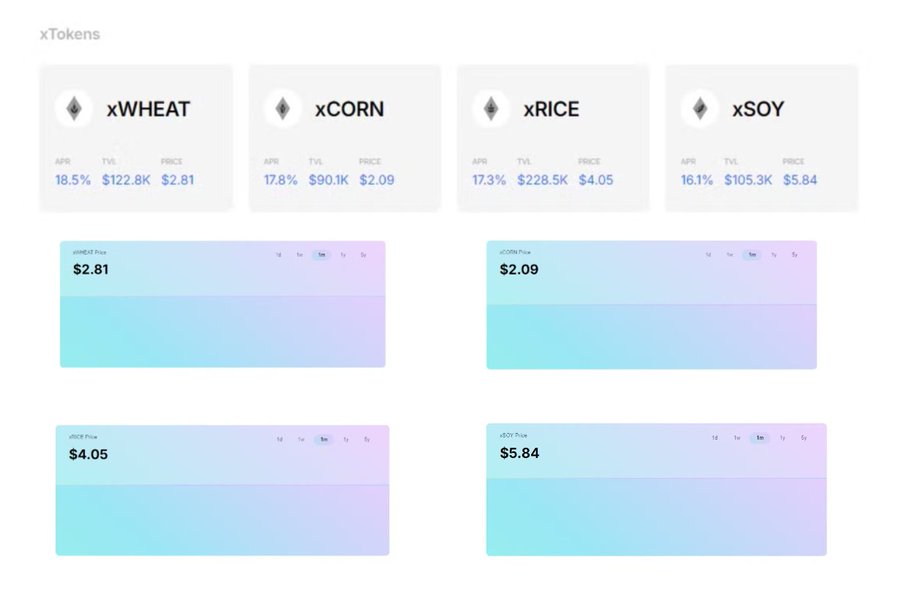

xTOKENS - inflation hedge perpetual vaults backed by real world crop share.

There's (currently) 4 different xToken assets, and, as you can see, their price is very stable. Yields? 16.1-18.5% APR paid in cTokens users can sell for USDC.

The overall xToken TVL isn't massive, it's a bit under $550k, but it's a safe haven for yield maxis. There's also the xBasket (basket of xTokens). The xBasket asset is auto-compounding the underlying, equally weighed xTokens, meaning, it's designde to slowly, but gradually increase in value because one xToken will, over time, comprise of more xTokens. From $3.49 in December 2023 to $3.91 at the time of writing.

I wrote about xTokens on many occasions and you can find threads and articles on my X profile, just hit the search bar, or scroll through the highlighted content.

So, the xTokens are for us DeFi advocates. What's there for real world farmers?

Funding!

You know governments are stingy whenever it's their turn to pay, but on the other hand, they're very quick to cash in a few bucks when it's their turn to collect cash. Obviously, this is a problem every nation under the Sun is dealing with, but it's even worse for people who run small businesses. Like small farmers would like to, but they get shackled by paperwork and legal stuff. And that's a pain in the ass worse than diarrhea. More so if you live in a less developed country.

How to connect farmers with DeFi maxis? LandX got it all sorted. The connections, the paperwork, all the burden one has to carry, it's all on LandX's shoulders, so to speak.

The solution is LandX's Credit Gateway. The name speaks for itself: it's a gateway for farmers to get funding. Who's funding? DeFi fam. Who's winning? All parties involved.

If you want to know how the Credit Gateway operates, I wrote a thread on that topic (and it's not even that long) and you can find the link here

In the image above, you can decypher what's going on.

TL;DR:

- DeFi fam lends out stablecoins (USDC) to real world farmers

- LandX leverages Aave for its Credit Gateway

- loans come with a maturity date farmers have to respect

- farmers collateralize their property as a means of assurance they'll repay the loans provided by DeFi fam

- DeFi fam earns fantastic yield (come on, 30% APY on USDC)

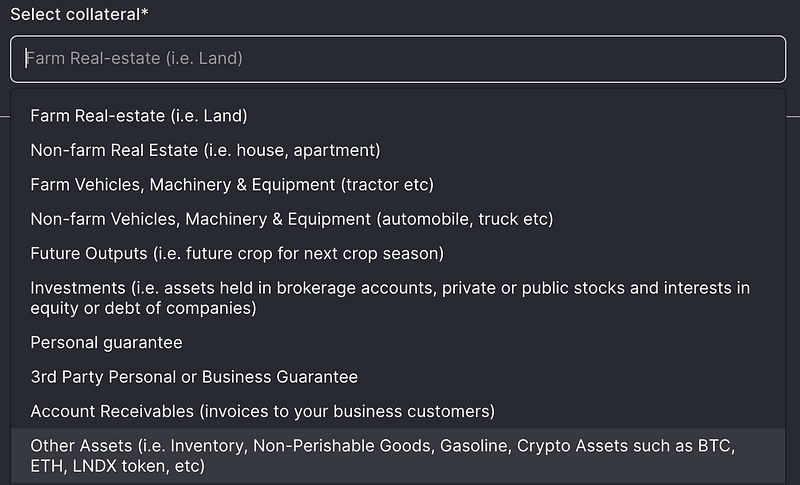

I mentioned that farmers have to collateralize their property (or assets) in order to be able to borrow from the LandX Credit Gateway. And really, the list of possible collateral types is something I haven't seen in DeFi yet:

What's interesting is, it's also possible to use LNDX as collateral. Something I haven't thought about earlier.

Anyway, the first lending pools in the Credit Gateway have been a success.

- caps were small

- yields were high

- farmers have repaid the debt in due time

So it's logical LandX has decided to spin up some more pools (you can see them in the snippet above).

Unsurprisingly, these pools are already filled. 2 pools that are used to fund a farming business in Bulgaria, and one that is used to support a farming business in Colombia -have reached their caps. And quite rapidly.

The Bulgarian ones, 2 different pools, 2 different maturity dates (if I'm not wrong), 2 different yield magnitudes. 16.38% APY in one, and 30.42% APY in the other pool.

As for the Colombian pool, it's a thing of beauty. First of all, it's got the highest cap so far (250k USDC), and it sold out rapidly. 20% APY, 6 months long maturity period.

The LandX team keeps shipping, silently and safely, so expect some beautiful updates soon (plus, they're low-key teasing with upcoming updates so pay attention once these are unveiled).

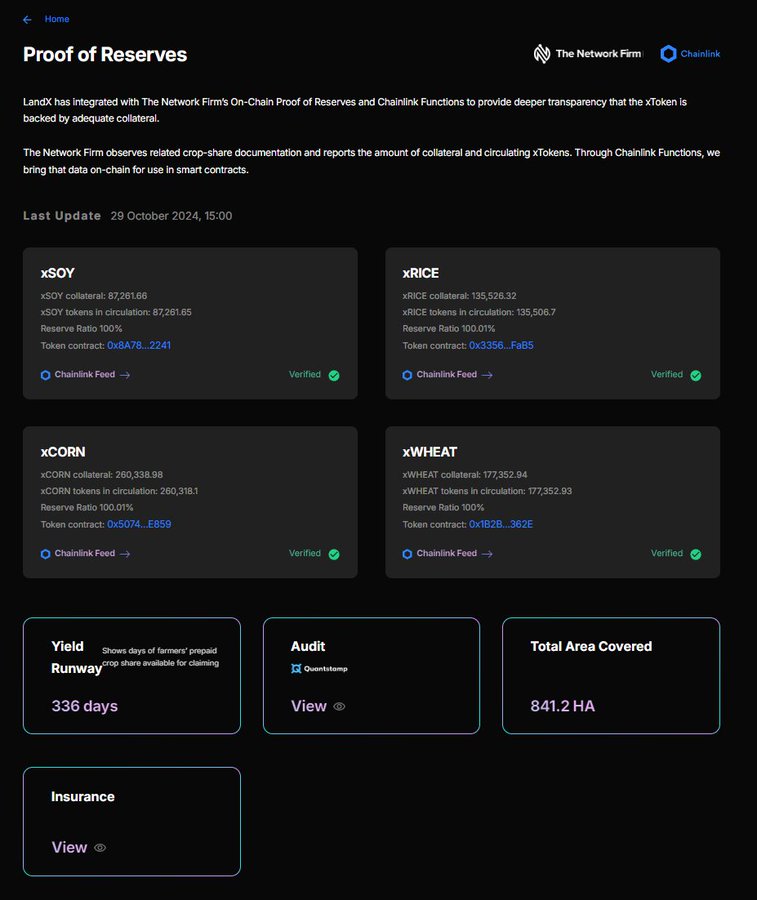

Transparent as glass in a fancy restaurant - LandX's Proof of Reserves (verified by Chainlink). You can see all the necessary info right there.

Last, but not least. the team recently (like, a week ago) raised the caps in the ISM pools (LNDX and xBASKET staking for juicy yield paid in xTokens and/or USDC) and these are, AGAIN, filled in a record time. So, no more space to deploy your LNDX or xBASKET and have them earn xTokens/USDC at 20.63%-39.62% APY. For now. These two pools now hold cumulatively $250k in deposits.

I know, for some, these numbers might not be something worth the awe, but LandX does things in a completely different way. Everything with maximum security, one step at a time.

Although the primary focus of LandX is to create a real world + blockchain DeFi flywheel empowering real world farmers and rewarding DeFi yield farmers, so, through the Credit Gateway and the xTokens, it's a noteworthy mention to say that the native token, LNDX is a tiny cap.

My good friend @CryptoGideon_ , summed LandX up with 7 simple (but very valid) points:

I won't speculate if LNDX is about to pop (again) and run back turbo, but I can say that I agree with Gideon: LandX is one of the undervalued RWA (real RWA) projects.

Join my brothers in farms, start with checking out LandX's Linktree right here

P.S. don't forget LandX will soon expand to Base. Just saying.