United Chains of Ethereum and Other Posts: Intern's Ramblings on L2, Privacy & The Future

Oct 22, 2024 | by Ethereum Intern | As we all know, rollups are the way the Ethereum community has chosen to scale. In their ideal form, they offer the best of both worlds: incredible speed from centralization while having accountability as a result of settling to mainnet.

As we all know, rollups are the way the Ethereum community has chosen to scale. In their ideal form, they offer the best of both worlds: incredible speed from centralization while having accountability as a result of settling to mainnet.

Rollups aren't quite there yet as many still at stage 0 (essentially a multisig) and some progressing towards stage 1 (operational permissionless proofs). But despite their current state, rollups present the best scaling solution for Ethereum at this moment.

For many epochs, there have been constant FUD on the timeline regarding rollups being centralized and terrible with fragmented liquidity and UX, and yet very recently the manlet community has made a sharp 180-degree turn on this, embracing "network extensions" in order to combat scalability issues. I consider this validation of the rollup-centric roadmap.

I hope one day we will have a vibrant, flourishing world of interconnected stage-2 rollups conducting the world's economy, all settling on top of Ethereum mainnet. But until then, it is our duty to fight for the cypherpunk values we believe in.

This article is a stream-of-thought disorganized ramble, sure, but it's about what I think is a likely future to happen if DeFi fully takes off, though history is incredibly path-dependent and the likeliest solution may not be the most optimal one. Regardless, it is still leaps and bounds ahead of what we have today, and ahead of what CeFi has to offer.

This is dedicated to all the rollup teams building a better future. @optimism, @arbitrum, @zksync, @taikoxyz, and many many more which I have not mentioned.

And, as always, NFA and DYOR.

Rollups are a special case of bridges

A rollup is essentially a separate blockchain with its own sequencing, execution, network of nodes, etc, but with one special characteristic: they have a trustless bridge to Ethereum.

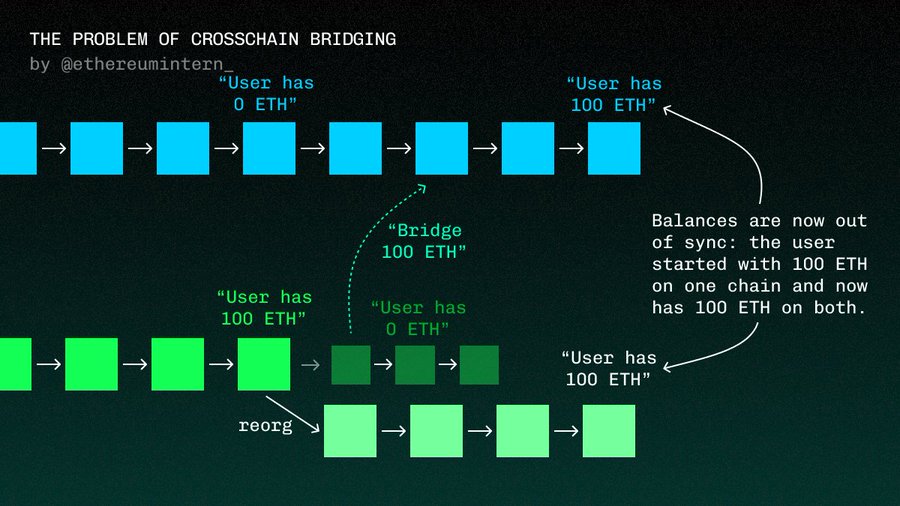

All bridges other than rollup bridges suffer from the issue that it is only as strong as its weakest chain. (Let's ignore the issue of multisig bridges and imagine the perfect light client bridge for now)

What this means is that if I bridge a few coins over from chain X to chain Y, and if chain X reverts afterwards, the bridge becomes desynced and a double-spend has just happened: my coins are available on both chains.

As long as the two chains have independent histories such that if one rolls back, the other doesn't, then the bridge can only be as secure as the weakest one of the two.

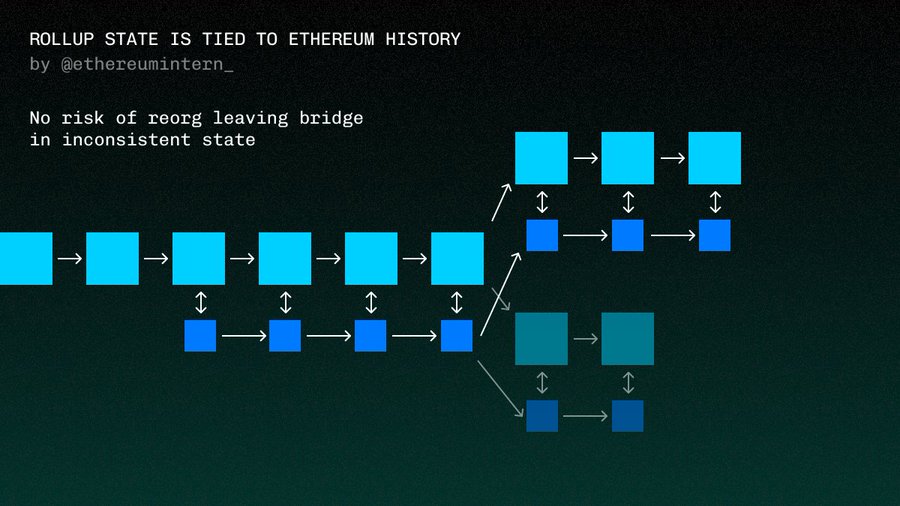

This is not possible with rollups because their history is tied to Ethereum history. If Ethereum rolls back, so do they, and they cannot roll back their own history without having to perform an expensive attack on Ethereum finality itself. Additionally, a user can force a transaction through the bridge on the Ethereum side, providing censorship resistance.

Thinking of a rollup as a separate blockchain linked to Ethereum by a trustless bridge is also a very helpful model in other ways. For example, if the rollup sequencer is unable to post to Ethereum, it can only result in loss of finality, not a total DDoS.

Of course, to ensure that the block is valid so that Ethereum can process any bridge transactions, it must be possible to enforce the chain's consensus rules onchain to ensure the state change posted is in fact valid and not trying to transition the state to "hahaha i steal all your moni".

To ensure the validity of rollup state transitions, there are two main paths, ZK and optimistic:

ZK rollups work by having batches of transactions sequenced and then posted onchain along with a 'ZK proof' that the computation was done correctly.

(I won't insult you with bad analogies, so it's a lot of very complex math that allows you to prove that a computation was done correctly without the verifier having to execute it.)

Optimistic rollups on the other hand treat blocks as innocent unless proven guilty. They are based on the idea that there's always at least one node watching and ready to prove that the batch posted by the sequencer(s) is invalid by initiating a dispute.

@2077Research has an excellent thread on different optimistic rollups' fraud proof systems, check it out here

The multiple megachain thesis

Some people say all apps will be built on their own separate appchains/approllups, vertically integrating all aspects of the stack and capturing value. Others say that there is no need for app rollups at all, and all use cases can be serviced by one or two big L2s.

My view is somewhere in between but leaning closer to the megachain side.

Yes, no singular chain will have the throughput necessary to handle all the world's transactions, financial and nonfinancial.

However, interoperability between two contracts on the same chain is synchronous, atomic, and quick. Doing that between contracts on different rollups will necessarily introduce additional latency and less composability.

I believe that over the long run, a few extremely-high-throughput L2s will dominate for the vast majority of applications even though the vast majority of network effects will fade due to chain abstraction. My bets: MegaETH, Base, OP Mainnet, Arbitrum and maybe Taiko.

For apps that absolutely require gas market isolation and total control at the cost of synchronous composability, an appchain may be useful, but my view is that app devs should probably avoid them and the current #1 reason for why they are needed (dedicated throughput) will become obsolete shortly after MegaETH launches.

(Prediction: upon the launch of @megaeth_labs, large L2s such as OP Mainnet and Arbitrum will scramble to copy the model to unlock higher throughput.)

Chain abstraction and the aggregated world

"Gentlemen, there's only two ways I know of to make money: bundling and unbundling." -Jim Barksdale

One conseqence of rollup fragmentation is that different rollups develop different cultures. Arbitrum is known for being a more serious chain, embracing DeFi, while Base is a more playful consumer-focused chain.

Chain abstraction will tear down L2 moats, relegating rollups to the status of behind-the-scenes infrastructure providers for the Ethereum world rather than communities on their own. (though it is slightly saddening to see these onchain subcultures disappear and be replaced)

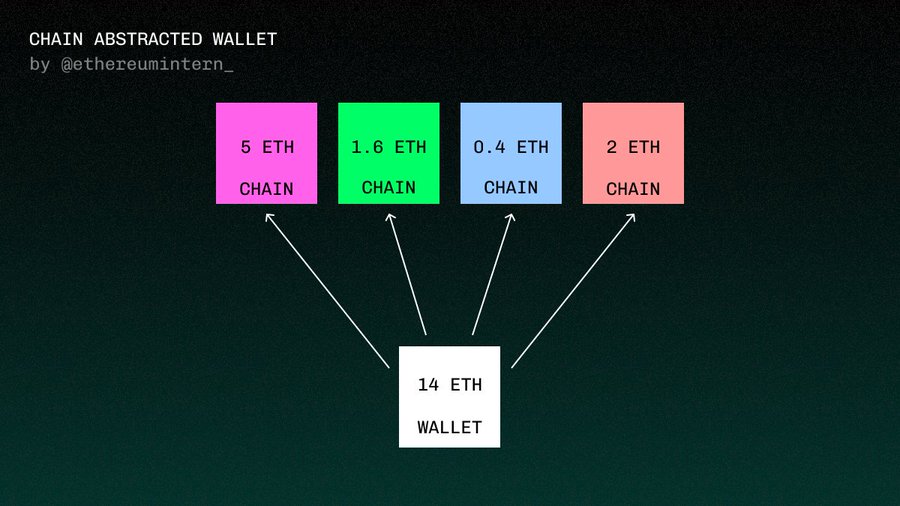

But what is chain abstraction? Chain abstraction is about hiding individual blockchains away from users to create a unified experience. Users will no longer see ten different balances of ETH in their wallets, but rather one aggregated balance. For example, using dapps on Base can be possible even without a Base balance as wallets can bridge with @AcrossProtocol, use something like MagicSpend++ to borrow funds on another chain or just make cross-chain calls, in the background.

DeFi protocols may want to compose with other chains too. Right now, it's too early to say which interop solution will win or if they will peacefully coexist and interoperate with each other, but here are some leads if you're interested:

@0xPolygon AggLayer

@zkSync Elastic Chain

Modeling Security for Cross Rollup Interoperability (an ETHResearch post)

@alt_layer VITAL & MACH

@nufflelabs Fast Finality

Private multichain AA wallets are a must

Hate to say it, but centralized finance actually excels at privacy compared to Ethereum. All transactions on EVM chains are fulliy visible to all parties. This is probably the biggest and most important issue with DeFi.

One privacy model I've been interested in for a long time is that of [@RAILGUN_Project](Private multichain AA wallets are a must). Though I'm not a fan of their fee extraction, in essence:

transactions within the RAILGUN system are fully private

users can interact with DeFi, hiding the sender

It is a good compromise solution that works at the moment while fully private rollups such as [@AztecNetwork](Private multichain AA wallets are a must) develop. And even if private execution environments do take off, there is still the network effect of the EVM and all its existing tooling.

Second, the one issue with pretty much all smart contract wallets today is the inability to sync data multichain. RAILGUN is quite a basic privacy system so it does not support social recovery or multisignature, but ideally we'd want to see better security features.

A theoretical solution to this is currently being developed by different teams is keystore rollups, which are specialized rollups dedicated toward the sole task of storing data that can then be read by wallets on other L2s by means of proving its state root.

We're far from the dream of fully private multichain wallets with social recovery, but I'm optimistic on the Ethereum community's ability to execute.

Pax Ethereum

To conclude what I believe is my largest post yet, clocking in at about 2,378 words according to the Twitter editor.

The Earth completes one rotation once every 24 hours, every 7200 slots, or 225 epochs, with approximately half of the planet in daylight and the other half left in darkness.

The New York Stock Exchange is open only 13-and-a-half hours out of those 24, between the hours of 9:30 AM and 8:00 PM ET. A holdover from pre-Internet times, it is similarly echoed by many banks and financial institutions on Wall Street.

Uniswap, Aerodrome, CoWSwap, all of these are operational 24 hours per day, 7 days a week, 365 or 366 days a year. They take no breaks, restricts nobody, and is available everywhere in the world.

Banks take months and large stacks of paperwork to get loans approved. You can take out a line of credit against your crypto in minutes with Aave, Morpho, or Euler.

DAOs are hard to classify in one category. Some can be like digital corporations, others like democratic communities that can manage money, or even potentially network states.

Onchain arbitration (@kleros_io, @kali__gg allows for over-the-Internet agreements without need for big companies to play judge.

Prediction markets provide accurate odds based on the expectations of financial markets in our hyper-polarized, post-truth world. The largest market in the world with over one billion dollars traded, Polymarket, runs on a sister chain to Ethereum and soon-to-be L2.

DeFi takes Wall Street out of Wall Street and scatters its essence throughout the world, opening up a frontier of competition against entrenched extractive institutions.

You are early. Like the Internet in 1994, Ethereum's future impact is not obvious until it happens.

Ethereum is the world's credibly neutral finance layer.

Ethereum is the backbone of the new Internet.

Ethereum will save the world.

-Ethereum Intern