Reasons for the collapse of the Russian Ruble

Dec 1, 2024 | Economy | Russia

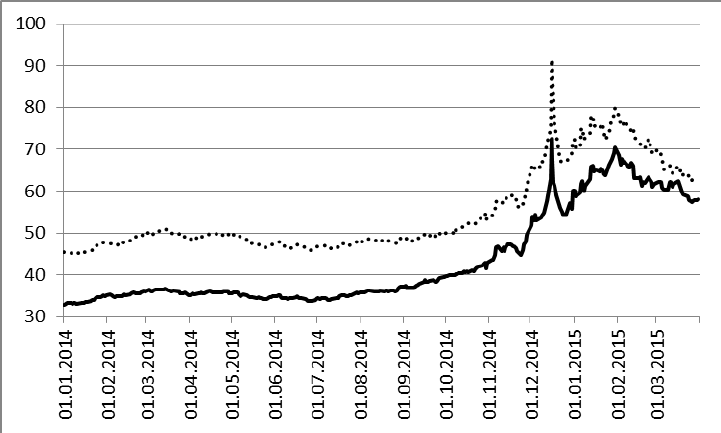

The Russian ruble has recently experienced significant depreciation against leading global currencies. At the time of the latest data, the dollar reached a rate of 113 rubles, and the euro - 119 rubles, marking highs since March 2022. In this article, we will explore the main reasons contributing to the ruble's collapse.

1. Western Sanctions and Restrictions

One of the key reasons for the decline of the ruble is the imposition of new sanctions against Russia. These sanctions limit access to international financial markets and reduce investor confidence in the Russian currency. They also hinder Russia's ability to export oil and gas, which are the primary sources of foreign currency revenue for the country.

2. Falling Oil Prices

Russia, being a major exporter of energy resources, heavily depends on oil prices. A decrease in oil prices on the global market directly affects the country's export earnings, leading to a reduced demand for rubles on the international market. While recent data indicates a rise in oil prices, this is a temporary effect, and fundamental issues persist.

3. Geopolitical Risks and Instability

An increase in geopolitical risks associated with international conflicts and tensions also adversely affects the ruble's exchange rate. Markets react to uncertainty, resulting in capital outflows from the country. Discussions about sanctions and military actions heighten volatility in the foreign exchange market.

4. Speculative Attacks

Speculators often bet against currencies that they believe are under pressure. With the ruble, the rise in geopolitical risks encourages speculative operations aimed at weakening the ruble. This is exacerbated by rumors and news regarding possible new sanctions or economic restrictions.

5. Economic Policy and Trust in the Central Bank

Decisions by the Central Bank of Russia and its policy on managing foreign exchange reserves and interest rates play a crucial role. It has been noted that the Central Bank's capabilities to prevent the ruble from plummeting have been exhausted, causing panic among investors and consumers.

6. Lack of Investment Appeal

Inflationary expectations and economic instability reduce Russia's appeal for foreign investments. Factors like high inflation decrease the purchasing power of the ruble, which does not contribute to its strengthening.

The collapse of the ruble is the result of a complex of reasons, including sanctions, falling oil prices, speculation, geopolitical risks, and domestic economic policy. These factors collectively exert pressure on the ruble's exchange rate, leading to its significant devaluation. Stabilizing the ruble will require a combination of internal reforms and an improvement in the foreign policy situation.