Hyperinflation: A Detailed Analysis and Its Consequences for Currency Systems

Now 14 | Hyperinflation

Introduction to Hyperinflation

Hyperinflation is an extreme form of inflation where prices for goods and services increase by thousands or even millions of percent per month. It's not just "high inflation"; hyperinflation represents an economic collapse where the monetary system loses its function as a medium of exchange and store of value.

Mechanisms Behind Hyperinflation

Hyperinflation usually arises under conditions of political instability, economic crisis, or as a result of uncontrolled money printing by the state. It can be triggered by several factors:

Excessive money issuance: Governments might print money to cover budget deficits, leading to currency devaluation.

Loss of trust: When the population and businesses lose faith in the currency, panic sets in, and people try to spend money as quickly as possible, accelerating inflation.

Economic sanctions or isolation: Lack of access to international markets and currencies can push towards hyperinflation.

Loss of productivity: Wars or natural disasters can sharply decrease the production of goods, increasing demand for money and goods.

Historical Examples of Hyperinflation

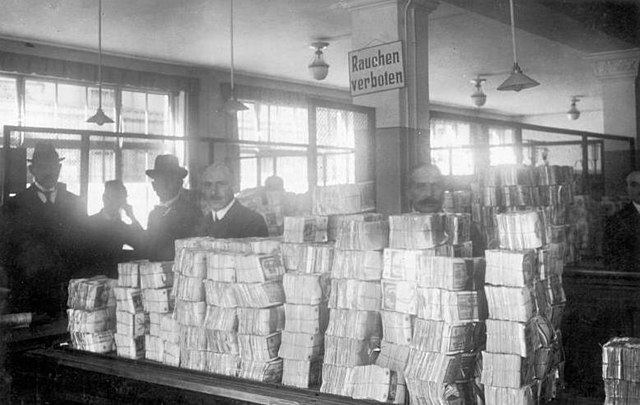

Weimar Germany (1921-1923): The most famous example, where the German mark devalued to the point where billions of marks were needed to buy a pack of cigarettes.

Zimbabwe (2007-2008): Zimbabwe experienced one of the highest hyperinflations with monthly rates reaching up to 89.7 sextillion percent.

Hungary (1945-1946): Here, hyperinflation was so extreme that prices doubled every 15 hours.

Economic and Social Consequences

Depreciation of savings: People lose their lifetime savings within a short period.

Loss of purchasing power: Money loses its value so rapidly that its use becomes impractical.

Social tension and political instability:

Hyperinflation often leads to social protests and changes in governance.

Change in economic behavior: People and companies begin using foreign currency or barter instead of the national currency.

Measures to Exit Hyperinflation

Denomination: Reissuing currency with a new denomination, often removing old notes from circulation.

Introduction of a new currency: Sometimes, countries introduce an entirely new currency to restore trust.

International assistance: Support from the IMF or other countries can help stabilize the economy.

Fiscal and monetary policy: Strict control over spending and money supply, reforms in the tax system, and management of the national debt.

Political stability: Restoring trust in the government through reforms and demonstrating the ability to manage the economy.

Long-term Effects on the Currency System

Dollarization or euroization: In countries that have experienced hyperinflation, there's often a shift to using foreign currency as the main medium of exchange and savings.

Financial system reforms: The need for reforms to ensure stability and prevent hyperinflation from recurring.

Change in money perception: Hyperinflation changes how the population views money, making them more skeptical towards the national currency and financial system overall.

Conclusion

Hyperinflation is the ultimate form of economic imbalance, leading to the destruction of the financial system and significant socioeconomic upheaval. Overcoming it requires a comprehensive approach, including economic reforms and restoring trust in government institutions. History shows that while hyperinflation is a rare phenomenon, its consequences leave a deep mark on the economy and society for years to come.